-

Compliance

Assistance in the design, implementation and monitoring of Compliance programs within the framework of local and international regulations (FCPA, Corporate Criminal Responsibility Law), including course delivery.

-

ESG & Sustainability

Projects related to ESG (environmental, social and governance) and Sustainability.

-

Forensic

The services offer includes expert advice in litigation resolution and the development of procedures in legal/digital forensics and cybersecurity.

-

Human Capital

Grant Thornton's Human Capital division has a team of professionals determined to accompany individuals and organizations throughout the relationship between the employee and the organization.

-

Organizational restructuring

Advice on operational restructuring to companies in difficulty, their creditors or other interested parties.

-

Services to the Government and the Public Sector

Financial audit projects and special technical and concurrent reviews of programs of national and subnational governments financed by International Credit Organizations. Special projects for government entities, public and mixed companies.

-

Valuation Services

We provide stock, business, asset, and liability valuations in support of negotiations, account structuring, and tax opportunities.

-

Transaction Advisory Services

The service offer includes financial due Diligence, operations services, business and strategic intelligence, ratings, advice on mergers and acquisitions, capital markets and debt advice.

-

Academy - Empowered by Grant Thornton Argentina & Perú

Academy is an e-learning platform that emerged as a joint initiative of Grant Thornton Argentina and Grant Thornton Perú. It is designed so that everyone can acquire new skills in accounting, auditing, taxes, technology and business through access to multiple courses and certifications.

-

External audit

We offer services of external audit of financial statements; assurance reports, agreed procedures and certifications; due-diligence and take-over of companies.

-

Audit methodology and technology

At Grant Thornton we use a single audit methodology across our global network. We apply it through an integrated set of software tools known as the Voyager suite. Meet it now.

-

Professional standards and training

Our IFRS advisors can help you navigate the complexity of the standards so you can spend your time and effort on your business.

-

Prevention of money laundering and financing of terrorism

At Grant Thornton we provide advice to our clients in the development of an Asset Laundering and Terrorist Financing Prevention strategy that allows them to prevent risks in a comprehensive manner.

-

Tax outsourcing

Taxes have a strong impact on your business decisions. At Grant Thornton we will respond quickly and tailor solutions for our clients.

-

Payroll

Put your payroll in good hands while you take your business beyond. Learn about our services.

-

Accounting, administration and finance services

To achieve the highest business benefits, you need an experienced team by your side. Learn about our services.

-

Start-up companies

Learn about our solutions to help build your business.

-

External audit

We offer services of external audit of financial statements; assurance reports, agreed procedures and certifications; due-diligence and take-over of companies.

-

AML - FIU Independent External Reviewer

We participate in the implementation of the requirements of the FIU in leading companies and our services ensure an orderly framework, optimizing the investment.

-

Internal audit

An internal audit helps identify gaps, deficiencies, and potential for inherent risk in all facets of the organization.

-

Legal audit

The monitoring of the legal area is usually a complex and difficult task for organizations, which however cannot be neglected.

-

Creation and acquisition of Financial Entities

We have the knowledge and experience in activities related to the acquisition and creation of financial entities, both locally and internationally.

-

Responsible for regulatory compliance

At Grant Thornton we offer the service of acting as "Responsible for Regulatory Compliance and Internal Control" for companies that requested registration as Settlement and Clearing Agent and Trading Agent.

-

Global Mobility Services

Sending someone abroad involves liabilities and obligations. We offer interesting solutions to minimize the tax burden for both parties.

-

Direct Tax

We provide clear and practical solutions that meet your specific business needs, in the most tax-efficient way possible.

-

Indirect Tax

Grant Thornton's tax teams take a rigorous approach to help you meeting your tax obligations, whatever challenges you may face along the way.

-

International taxes – Transaction support

We offer our international experience in the field and make available the resources to plan and adequately comply with regulatory frameworks.

-

Services to private clients

Wherever you are in the world, our tax specialists can help you with your interests and investments abroad.

-

Clean energy and technology

Growing demand, development of new ways of energy and need of a sustainable future: we accompany our client in these changes and to be one step ahead.

-

Mining

Our flexible, partner-led teams are dynamic and focused on development. We take time to understand the details of the client’s business and offer unique solutions.

-

Oil and gas

Our Oil & Gas teams have the deep knowledge, wide experience and vision needed to offer our clients practical solutions adapted to their businesses.

-

Banking

Grant Thornton offers meaningful and accurate solutions for operational and transactional issues, litigation and administrative disputes in banking.

-

Private capital

We gather international teams of experts in corporate finance, restructuring and recovery, tax and insurance services to deliver customized solutions from initial investment, through development stages until the end of each project.

-

Fintech

We work to take advantage of all opportunities and manage industry risks, allowing our clients to always be one step beyond their competitors.

-

Asset management

We have specialized teams in more than 140 markets delivering solutions regarding insurance, taxes and advisory to global, international, regional, local asset managers.

-

Insurance

Thanks to our specialized team we offer accurate solutions for operational and transactional matters, litigations and administrative conflicts.

Key findings from our quarterly economic update

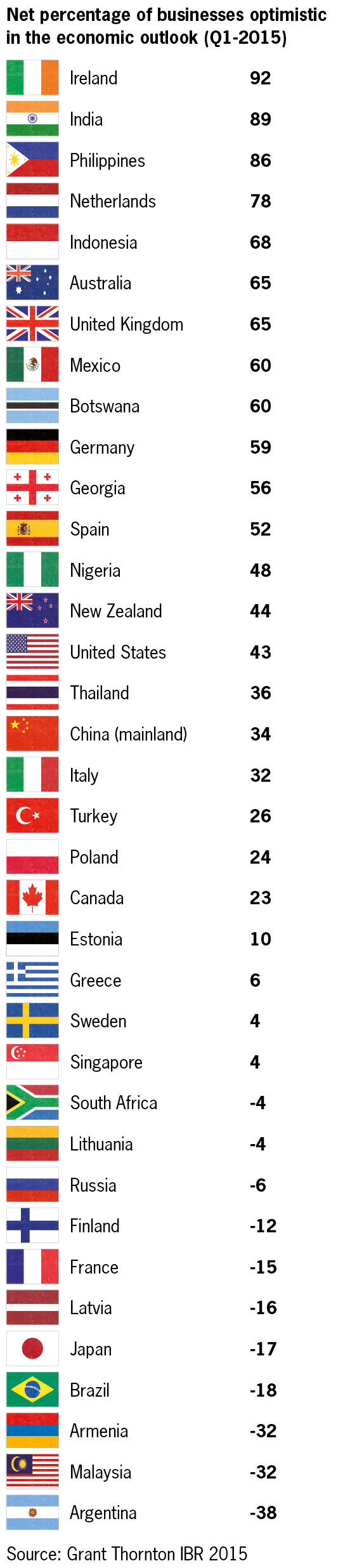

Almost three months on from the launch of the European Central Bank's quantitative easing programme, new research from the Grant Thornton International Business Report (IBR) [ 741 kb ]reveals a jump in business optimism in the eurozone in the first quarter of 2015, with confidence moving back up towards pre-crisis levels. Many of the economies hardest hit by the financial crisis, such as Ireland and Spain, are increasingly optimistic about their growth prospects although the global picture is mixed, with Latin America falling to an all-time low.

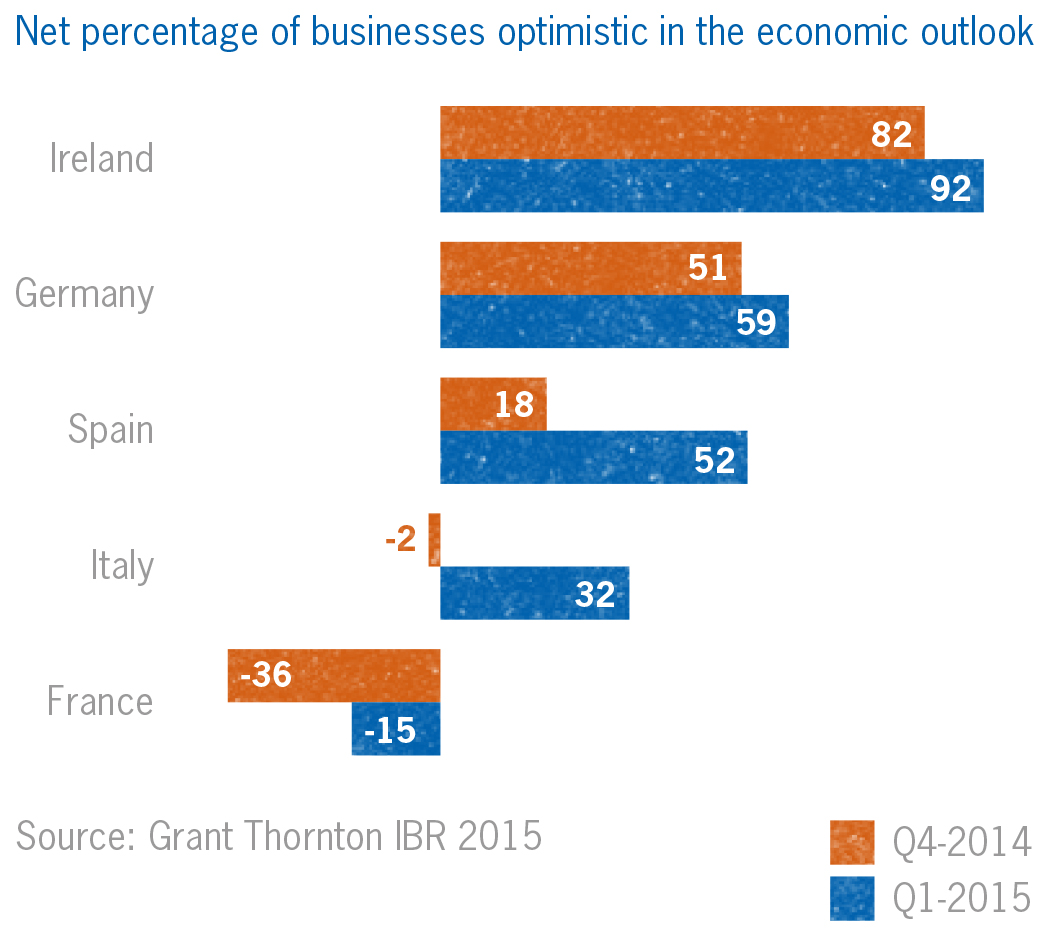

The IBR shows that net 34% of business leaders in the eurozone are optimistic in the economic outlook, up from just 13% in Q4-2014 and just 5% in Q3-2014. The resurgence has been driven largely by improvements in Spain (52%), Italy (32%) and Ireland (92%) - with the latter currently the most optimistic business community in the world. German businesses remain bullish (59%) with their French peers (-15%) still overwhelmingly pessimistic, although less so compared with the previous quarter.

Francesca Lagerberg, global leader for tax services at Grant Thornton, commented:

“We’ve seen a few false dawns in the eurozone following the sovereign debt crisis but when you consider how buoyant these figures are in the context of the uncertainty caused by the Greek elections, this could indicate a decisive turning point in the regional economy. Following the lead of the UK and the US, quantitative easing looks to have had the immediate effect that policymakers were hoping for, giving businesses the confidence and support they need to invest in the growth of their operations.

“Germany continues to drive the currency bloc, but it is heartening to see the amazing transformation in countries such as Ireland, Italy and Spain. Major austerity drives have caused severe discomfort for businesses and consumers but there is now a growing feeling of light at the end of the tunnel. With an improving real estate sector in Spain, higher exports and investment spending in Ireland and the anti-corruption drive in Italy, it is no surprise that businesses are increasingly optimistic about growth prospects.”

Expectations for increasing revenues and profits are high in each of these three economies. In Spain, 59% of businesses expect to increase revenues over the next 12 months, and 50% expect profits to go the same way. Ireland is even more buoyant with 70% positive on revenues and 66% on profits. Italian businesses are slightly less bullish but have posted double digit climbs in both indicators over the past three months.

Francesca Lagerberg added:

“European firms will take heart from this transformation and we expect businesses to invest more in people, research and development and facilities as uncertainty subsides. However there is one cloud on the horizon: the prospect of a Greek exit from the eurozone. The region is probably better insulated than it was three years ago but business leaders will be watching the situation very closely indeed.”

Global outlook

Globally, the increase in optimism in Europe is mitigated by sharp downturns in Latin America and Eastern Europe. Driven by Brazil (-18%), Latin America has fallen to an all-time low of 5%. Business confidence in Eastern Europe has dropped to just 6% with Russian businesses increasingly pessimistic (-6%).

Francesca Lagerberg concluded:

“Brazil is suffering from the major corruption scandal surrounding Petrobras which is threatening to topple the government, while economic sanctions are having a severe impact on the Russian economy. By contrast, China and India are moving strongly ahead. The BRICs are certainly no longer moving in lockstep.”

To learn more, explore the full quarterly results via our data visualisation tool or view the Q1 optimism infographic [ 741 kb ].