-

Compliance

Assistance in the design, implementation and monitoring of Compliance programs within the framework of local and international regulations (FCPA, Corporate Criminal Responsibility Law), including course delivery.

-

Sustainability

Learn how our sustainability services can help you go beyond and build a strong reputation, attract committed investors and generate long-term sustainable financial results.

-

Forensic

The services offer includes expert advice in litigation resolution and the development of procedures in legal/digital forensics and cybersecurity.

-

Human Capital solutions

Grant Thornton's Human Capital division has a team of professionals determined to accompany individuals and organizations throughout the relationship between the employee and the organization.

-

Organizational restructuring

Advice on operational restructuring to companies in difficulty, their creditors or other interested parties.

-

Services to the Government and the Public Sector

Financial audit projects and special technical and concurrent reviews of programs of national and subnational governments financed by International Credit Organizations. Special projects for government entities, public and mixed companies.

-

Valuation Services

We provide stock, business, asset, and liability valuations in support of negotiations, account structuring, and tax opportunities.

-

Transaction Advisory Services

The service offer includes financial due Diligence, operations services, business and strategic intelligence, ratings, advice on mergers and acquisitions, capital markets and debt advice.

-

Academy - Empowered by Grant Thornton Argentina & Perú

Academy is an e-learning platform that emerged as a joint initiative of Grant Thornton Argentina and Grant Thornton Perú. It is designed so that everyone can acquire new skills in accounting, auditing, taxes, technology and business through access to multiple courses and certifications.

-

External audit

We offer services of external audit of financial statements, assurance reports, agreed-upon procedures reports and certifications, due-diligence and take-over of companies.

-

Audit methodology and technology

At Grant Thornton we use a single audit methodology across our global network. We apply it through LEAP, an integrated software audit tool. Get to know it now.

-

Professional standards and training

Our IFRS advisors can help you navigate the complexity of the standards so you can spend your time and effort on your business.

-

Prevention of money laundering and financing of terrorism

At Grant Thornton we provide advice to our clients in the development of an Asset Laundering and Terrorist Financing Prevention strategy that allows them to prevent risks in a comprehensive manner.

-

Tax outsourcing

Taxes have a significant impact on business decisions. At Grant Thornton, we respond quickly and design tailored solutions to ensure organizations are not adversely affected.

-

Payroll

We have the experience and the know-how to perform payroll for various industries, including those in which trade unions and workers' organisations are active.

-

Accounting, administration and finance services

Effective accounting and financial advisory are necessary for the success of an innovative and forward-thinking organization. We provide our knowledge and experience so you can stay focused on your business's core activities.

-

Start-up of companies

The early stages of a business are key to its success. Therefore, it's important to have experts who manage and administer business resources. Learn about our solutions to help you build your company.

-

Financial statements audit

We offer services of external audit of financial statements; assurance reports, agreed procedures and certifications; due-diligence and take-over of companies.

-

FIU Independent External Reviewer - AML/CFT

We participate in the implementation of the requirements of the FIU in leading companies and our services ensure an orderly framework, optimizing the investment.

-

Internal audit

An internal audit helps identify gaps, deficiencies, and potential for inherent risk in all facets of the organization.

-

Legal audit

The monitoring of the legal area is usually a complex and difficult task for organizations, which however cannot be neglected.

-

Creation and acquisition of Financial Entities

We have the knowledge and experience in activities related to the acquisition and creation of financial entities, both locally and internationally.

-

Responsible for regulatory compliance

At Grant Thornton we offer the service of acting as "Responsible for Regulatory Compliance and Internal Control" for companies that requested registration as Settlement and Clearing Agent and Trading Agent.

-

IT Internal Audit

IT has been, and will increasingly be, a key factor for success and operational efficiency in all industries. Innovations such as the cloud and virtualization, and new threats around data security, have reinforced the importance and increased the risks associated with the use of technology for our clients.

-

Cybersecurity

As sophisticated digital manipulations become more prevalent, organizations must strengthen their defences and effectively protect themselves from threats and recognize those that are not. Organizations must act quickly to strengthen trust and resilience. A combination of enhanced security capabilities, robust controls, and employee education and awareness is critical.

-

ITGC Controls

Information Technology General Controls (ITGC) are a set of policies that ensure the effective implementation of control systems throughout an organization. ITGC audits help verify that these general controls are implemented and functioning correctly, so that risk is appropriately managed.

-

Global Mobility Services

Sending someone abroad involves liabilities and obligations. We offer interesting solutions to minimize the tax burden for both parties.

-

Direct Tax

We provide clear and practical solutions that meet your specific business needs, in the most tax-efficient way possible.

-

Indirect Tax

Grant Thornton's tax teams take a rigorous approach to help you meeting your tax obligations, whatever challenges you may face along the way.

-

International taxes – Transaction support

We offer our international experience in the field and make available the resources to plan and adequately comply with regulatory frameworks.

-

Services to private clients

Wherever you are in the world, our tax specialists can help you with your interests and investments abroad.

-

LATAM Tax Newsletter

Stay informed with the latest tax developments across Latin America with the LATAM Tax Newsletter, prepared by our experts throughout the Americas.

-

Clean energy and technology

Growing demand, development of new ways of energy and a need for a sustainable future: we support our clients in these changes to be one step beyond their competitors.

-

Mining

Our flexible, partner-led teams are dynamic and focused on development. We take time to understand the details of the client’s business and offer unique solutions.

-

Oil and gas

Our Oil & Gas teams have the deep knowledge, wide experience and vision needed to offer our clients practical solutions adapted to their businesses.

-

Banking

Grant Thornton offers meaningful and accurate solutions for operational and transactional issues, litigation and administrative disputes in banking.

-

Private capital

We gather international teams of experts in corporate finance, restructuring and recovery, tax and insurance services to deliver customized solutions from initial investment, through development stages until the end of each project.

-

Fintech

We work to take advantage of all opportunities and manage industry risks, allowing our clients to always be one step beyond their competitors.

-

Asset management

We have specialized teams in more than 140 markets delivering solutions regarding insurance, taxes and advisory to global, international, regional, local asset managers.

-

Insurance

Thanks to our specialized team we offer accurate solutions for operational and transactional matters, litigations and administrative conflicts.

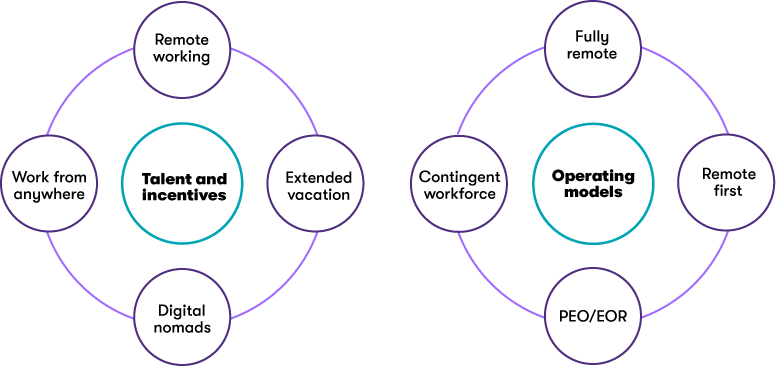

Employees today have shown that if employers can’t deliver the career development opportunities and lifestyle choices they want -from flexibility in working schedule, hybrid working between the office and home, to the ability to work an extended period overseas for example- they are willing to seek them elsewhere.

At the same time, there has been a shift in how many companies engage talent, as shown by a considerable increase in contingent labor through contractors or short-term contracts. Some companies have set up, maintained or transitioned to operating on a fully remote basis without physical offices. Others encourage remote-first, with office space being downsized or physical space limited as the company grows.

"As an employer brand, digital nomadism can be a powerful differentiator in attracting and retaining talent. Offering the possibility of working remotely from anywhere not only reflects a flexible and modern organizational culture, but also appeals to the expectations of the new generation of workers who value autonomy and a balance between work and personal life," highlights Matiana Behrends, Advisory Services Partner at Grant Thornton Argentina.

"As an employer brand, digital nomadism can be a powerful differentiator in attracting and retaining talent. Offering the possibility of working remotely from anywhere not only reflects a flexible and modern organizational culture, but also appeals to the expectations of the new generation of workers who value autonomy and a balance between work and personal life," highlights Matiana Behrends, Advisory Services Partner at Grant Thornton Argentina.

"In addition, promoting a nomad lifestyle can enhance the company's reputation, positioning it as innovative and adaptable, which attracts candidates who are looking not only for a job, but for an enriching and diverse work experience," she adds.

Diversification in talent

From an operating perspective, professional employment organizations (PEO) and employers of record (EOR) have also increased in popularity, as an expanding labor market brings a significant number of new entrants alongside established vendors. These vendors allow businesses to engage employees in countries where they do not have a legal presence, with the EOR/PEO assuming the compliance and payroll requirements and effectively loaning the employee to the engaging company.

From a talent perspective, the concept of remote work has increased in popularity significantly. From being a relatively uncommon arrangement or restricted in many situations, remote and hybrid working has now become a necessity in many companies, and as a consequence, shifted the balance of power to employees. From highly skilled employees, employees in senior positions, to roles that require less or no in-person working, some employees have been able to negotiate longer-term remote working arrangements or influence company policy. This requires input from tax and finance departments to balance risks and compliance while HR and talent requirements necessitate an approach that enables mobility rather than inhibits employee movement.

Digital nomadism

In recent years, the introduction of a category of “digital nomad visas” has expanded, allowing employees to work in a country without needing a local employment contract, immigration sponsorship from an employer, or the personal expense that investment visas may require.

“Argentina has launched its digital nomad visa in May 2022”, explains Julia Adano, Lead Tax Partner at Grant Thornton Argentina. “This allows foreigners to work remotely, either for themselves or for a foreign company outside of Argentina and is valid for 180 days and renewable for an additional 180 days.”

“Argentina has launched its digital nomad visa in May 2022”, explains Julia Adano, Lead Tax Partner at Grant Thornton Argentina. “This allows foreigners to work remotely, either for themselves or for a foreign company outside of Argentina and is valid for 180 days and renewable for an additional 180 days.”

A Harvard Business Review articlei describes digital nomadism as “a lifestyle where one leverages remote work to travel and live in varying, often affordable locations around the world.” Interest from employers in digital nomad arrangements is increasing, in part due to the increase in the number of countries offering digital nomad visas since the end of the pandemic and the ability to enable mobility with relative ease.

These incentives also create risks, as a recent Grant Thornton surveyii showed that 49% of respondents identified remote working as the key mobility tax risk issue to manage. While encouraging digital nomadism may appear attractive as a means of incentivizing employees and enabling increased mobility, companies should be aware of the potential tax risks of such visa programs.

A widespread misperception of digital nomad arrangements is that there is limited exposure to income tax and tax compliance obligations at the individual taxpayer level along with correspondingly limited employer responsibilities like payroll and employment taxes, and critically limited or corporate tax exposure and compliance obligations.

Few countries, however, offer specific tax breaks for either employees or employers. A Grant Thornton review of 21 countries found 79% of digital nomad visas have no relief from individual tax while 85% have no exemption from corporate tax risk.

“From an income tax point of view, in Argentina, non-resident individuals are only required to pay the tax to the extent that they perform activities that Argentine legislation considers to be of ‘Argentine source’ (activities carried out within national territory)”, highlights Julia Adano. “However, if the person is in the country for a period not longer than 180 days, the person will qualify as foreign beneficiary, and if there is no local company that makes the payment of his or her wage, in practice, no income tax withholding will be possible”.

“From an income tax point of view, in Argentina, non-resident individuals are only required to pay the tax to the extent that they perform activities that Argentine legislation considers to be of ‘Argentine source’ (activities carried out within national territory)”, highlights Julia Adano. “However, if the person is in the country for a period not longer than 180 days, the person will qualify as foreign beneficiary, and if there is no local company that makes the payment of his or her wage, in practice, no income tax withholding will be possible”.

“Regarding social security obligations, there are no general exemptions applicable. Although from the first day, the person who is in Argentina would have to pay Social Security. If there is no local company that makes the payment of his/her wage, in practice, no payroll taxes will be applicable”, she adds.

“In Argentina, the digital nomad visa does not provide an exemption from income tax neither payroll obligations, and if the person is in the country for more than 180 days, local residents’ general regime will apply with the obligation to register for income tax and pay the tax due”, concludes Adano.

Benefits of digital nomadism to countries:

- Talent attraction, diversification and upgrading workforce

- Targeting growth and upskilling in certain industries

- Economic benefits – tourism, taxes, local economy boosts

Benefits of digital nomadism for employers:

- Removes immigration compliance risk

- Provides mobility opportunities where no business need for relocation or an assignment

- Expands an existing remote work policy to more countries

- Extends remote working timeframes beyond market trends of up to 30 days

- Delivers on a promise of “work from anywhere”

The tax risk reality

Without specific tax relief under a digital nomad visa program or provided under a double tax treaty, companies must rely on tax laws in the country the digital nomad employee is working to determine the potential tax exposure that could arise from having an employee working remotely on a digital nomad visa. In this circumstance, a corporate taxable presence may be deemed to exist, potentially resulting in corporate and other entity taxes and obligations, including:

- Corporate registration with tax authorities

- Filing of corporate tax returns

- Attribution of profit and transfer pricing considerations

- Liability to corporate income tax

- Liability to indirect taxes

- Potential tax authority scrutiny of activity

A range of employer obligations may also arise, requiring a company to comply with local regulations and potential exposure to employer taxes and other tax risk, where:

- A company has a local entity and thus operates payroll to report an employee’s taxable income, calculate and remit taxes

- There is no local entity and a company must register with the local authorities and operate a local payroll to report and remit taxes

- Payroll operation is required and withholding and remittance of taxes does not occur, the full balance of unpaid tax may fall due on the company. Penalties and interest may further be assessed if there is non-compliance with local employer obligations

- A company may be liable to provide statutory benefits to employees, with some countries allowing employees to litigate to claim benefits not received.

For companies exploring the use of digital nomad visa programs as an opportunity to expand remote working arrangements for employees, careful review is required to ensure the tax implications are fully understood and the company does not assume unwanted financial exposure.

i. The New Reality of Digital Nomads,. Eckerhardt & Atanasova, Harvard Business Review, February 5, 2024

ii. www.grantthornton.com/events-and-webcasts/tax/2024/tax-symposium-2024/07-25-tax-symposium-global-mobility-remote-workforce-trends-and-leveraging-data-for-an-ai-future