-

Compliance

Assistance in the design, implementation and monitoring of Compliance programs within the framework of local and international regulations (FCPA, Corporate Criminal Responsibility Law), including course delivery.

-

ESG & Sustainability

Projects related to ESG (environmental, social and governance) and Sustainability.

-

Forensic

The services offer includes expert advice in litigation resolution and the development of procedures in legal/digital forensics and cybersecurity.

-

Human Capital

Grant Thornton's Human Capital division has a team of professionals determined to accompany individuals and organizations throughout the relationship between the employee and the organization.

-

Organizational restructuring

Advice on operational restructuring to companies in difficulty, their creditors or other interested parties.

-

Services to the Government and the Public Sector

Financial audit projects and special technical and concurrent reviews of programs of national and subnational governments financed by International Credit Organizations. Special projects for government entities, public and mixed companies.

-

Valuation Services

We provide stock, business, asset, and liability valuations in support of negotiations, account structuring, and tax opportunities.

-

Transaction Advisory Services

The service offer includes financial due Diligence, operations services, business and strategic intelligence, ratings, advice on mergers and acquisitions, capital markets and debt advice.

-

Academy - Empowered by Grant Thornton Argentina & Perú

Academy is an e-learning platform that emerged as a joint initiative of Grant Thornton Argentina and Grant Thornton Perú. It is designed so that everyone can acquire new skills in accounting, auditing, taxes, technology and business through access to multiple courses and certifications.

-

External audit

We offer services of external audit of financial statements; assurance reports, agreed procedures and certifications; due-diligence and take-over of companies.

-

Audit methodology and technology

At Grant Thornton we use a single audit methodology across our global network. We apply it through an integrated set of software tools known as the Voyager suite. Meet it now.

-

Professional standards and training

Our IFRS advisors can help you navigate the complexity of the standards so you can spend your time and effort on your business.

-

Prevention of money laundering and financing of terrorism

At Grant Thornton we provide advice to our clients in the development of an Asset Laundering and Terrorist Financing Prevention strategy that allows them to prevent risks in a comprehensive manner.

-

Tax outsourcing

Taxes have a strong impact on your business decisions. At Grant Thornton we will respond quickly and tailor solutions for our clients.

-

Payroll

Put your payroll in good hands while you take your business beyond. Learn about our services.

-

Accounting, administration and finance services

To achieve the highest business benefits, you need an experienced team by your side. Learn about our services.

-

Start-up companies

Learn about our solutions to help build your business.

-

External audit

We offer services of external audit of financial statements; assurance reports, agreed procedures and certifications; due-diligence and take-over of companies.

-

AML - FIU Independent External Reviewer

We participate in the implementation of the requirements of the FIU in leading companies and our services ensure an orderly framework, optimizing the investment.

-

Internal audit

An internal audit helps identify gaps, deficiencies, and potential for inherent risk in all facets of the organization.

-

Legal audit

The monitoring of the legal area is usually a complex and difficult task for organizations, which however cannot be neglected.

-

Creation and acquisition of Financial Entities

We have the knowledge and experience in activities related to the acquisition and creation of financial entities, both locally and internationally.

-

Responsible for regulatory compliance

At Grant Thornton we offer the service of acting as "Responsible for Regulatory Compliance and Internal Control" for companies that requested registration as Settlement and Clearing Agent and Trading Agent.

-

Global Mobility Services

Sending someone abroad involves liabilities and obligations. We offer interesting solutions to minimize the tax burden for both parties.

-

Direct Tax

We provide clear and practical solutions that meet your specific business needs, in the most tax-efficient way possible.

-

Indirect Tax

Grant Thornton's tax teams take a rigorous approach to help you meeting your tax obligations, whatever challenges you may face along the way.

-

International taxes – Transaction support

We offer our international experience in the field and make available the resources to plan and adequately comply with regulatory frameworks.

-

Services to private clients

Wherever you are in the world, our tax specialists can help you with your interests and investments abroad.

-

Clean energy and technology

Growing demand, development of new ways of energy and need of a sustainable future: we accompany our client in these changes and to be one step ahead.

-

Mining

Our flexible, partner-led teams are dynamic and focused on development. We take time to understand the details of the client’s business and offer unique solutions.

-

Oil and gas

Our Oil & Gas teams have the deep knowledge, wide experience and vision needed to offer our clients practical solutions adapted to their businesses.

-

Banking

Grant Thornton offers meaningful and accurate solutions for operational and transactional issues, litigation and administrative disputes in banking.

-

Private capital

We gather international teams of experts in corporate finance, restructuring and recovery, tax and insurance services to deliver customized solutions from initial investment, through development stages until the end of each project.

-

Fintech

We work to take advantage of all opportunities and manage industry risks, allowing our clients to always be one step beyond their competitors.

-

Asset management

We have specialized teams in more than 140 markets delivering solutions regarding insurance, taxes and advisory to global, international, regional, local asset managers.

-

Insurance

Thanks to our specialized team we offer accurate solutions for operational and transactional matters, litigations and administrative conflicts.

The resilience of the global economy has been highlighted by a record number of mid-market business leaders expecting an increase in profitability (up two points to 62%) over the next 12 months, with 53% expecting to increase their selling prices (up three points), according to Grant Thornton’s latest International Business Report (IBR).

This bullish outlook saw optimism rise one point to 66%, despite forecasts indicating global GDP growth will remain below historic averages. The uncertainty created by a record number of people voting in national elections this yeari along with the ongoing challenges posed by above target inflation and higher interest rates, are thought to be weighing on growth forecasts.

Why then are mid-market business leaders so bullish about the prospects for their businesses? It could be driven by the record number of respondents expecting to increase their investment in information technology (up five points to 66%), and a record number of respondents expecting to increase investment in research and development (up three points to 55%).

With both selling prices and profitability expected to rise – absorbing any long-tail inflationary pressures – and optimism remaining high, businesses clearly have the confidence to invest.

With all the hype around AI and its potential impact on business, it is little surprise that business leaders are opting to invest in this potentially transformative area. However, this is not likely to lead to mass job cuts. A record number of respondents also expect to increase investment in their people (up two points to 58%). This would suggest that investment in technology sits alongside investment in talent and that a combination of both is needed to deliver sustainable growth.

Despite a gloomy geo-political outlook, businesses are also more hopeful about their own international prospects. A record number of respondents expect an increase in revenue from non-domestic markets over the next 12 months (up three points to 45%). Those expecting exports to increase is also up four points to 47% and those expecting to increase the number of countries they sell to is up two points to 42%.

Business constraints

There is, however, no getting away from the gloomy geo-political situation. Economic uncertainty remains the largest constraint cited by business leaders (down one point to 56%). Those citing the availability of skilled workers is up three points to 53% and concerns over labour costs is up two points to 53% - highlighting the challenge posed by persistent or sticky inflation as it has been labelled.

Pressure from energy costs appears to be easing, with those citing it as a constraint down one point to 51%.

Businesses may not be investing in technology solely for productivity reasons. With 50% of business leaders citing cybersecurity as a constraint, it may also be a defensive investment as cyber-attacks become more frequent and sophisticated.

Surprisingly, shortage of finance is the least cited concern for business leaders, remaining static at 40%. This may be explained by more businesses holding excess cash on their balance sheet according to research by the Harvard Business Reviewii , which acts as a form of insurance against adverse events.

Peter Bodin, CEO of Grant Thornton International commented: “Our latest IBR findings highlight the continuing resilience of the global economy and of the global mid-market. It’s clear that, with improving profitability, CEOs are targeting investment in innovation, whether through R&D or technology, to win market share in a flat global economy. The pressure is clearly on business leaders to make the right investment choices to make sure they are not left behind by competitors – or their customers. Relying on what has always worked in the past may no longer be good enough if AI delivers the transformation some predict it will.

“With a global surplus of alternative financing and record-high cash reserves, our data highlights that concerns regarding finance shortages have also waned. The value of maintaining cash reserves to navigate unpredictable market conditions could now be put to the test.

”Despite the ongoing uncertainty created by geopolitical tensions and a record number of national elections, businesses simply cannot afford to do nothing. Those business leaders prioritising strategic investment and operational resilience to optimise their operations will be best positioned for success.”

Argentine outlook

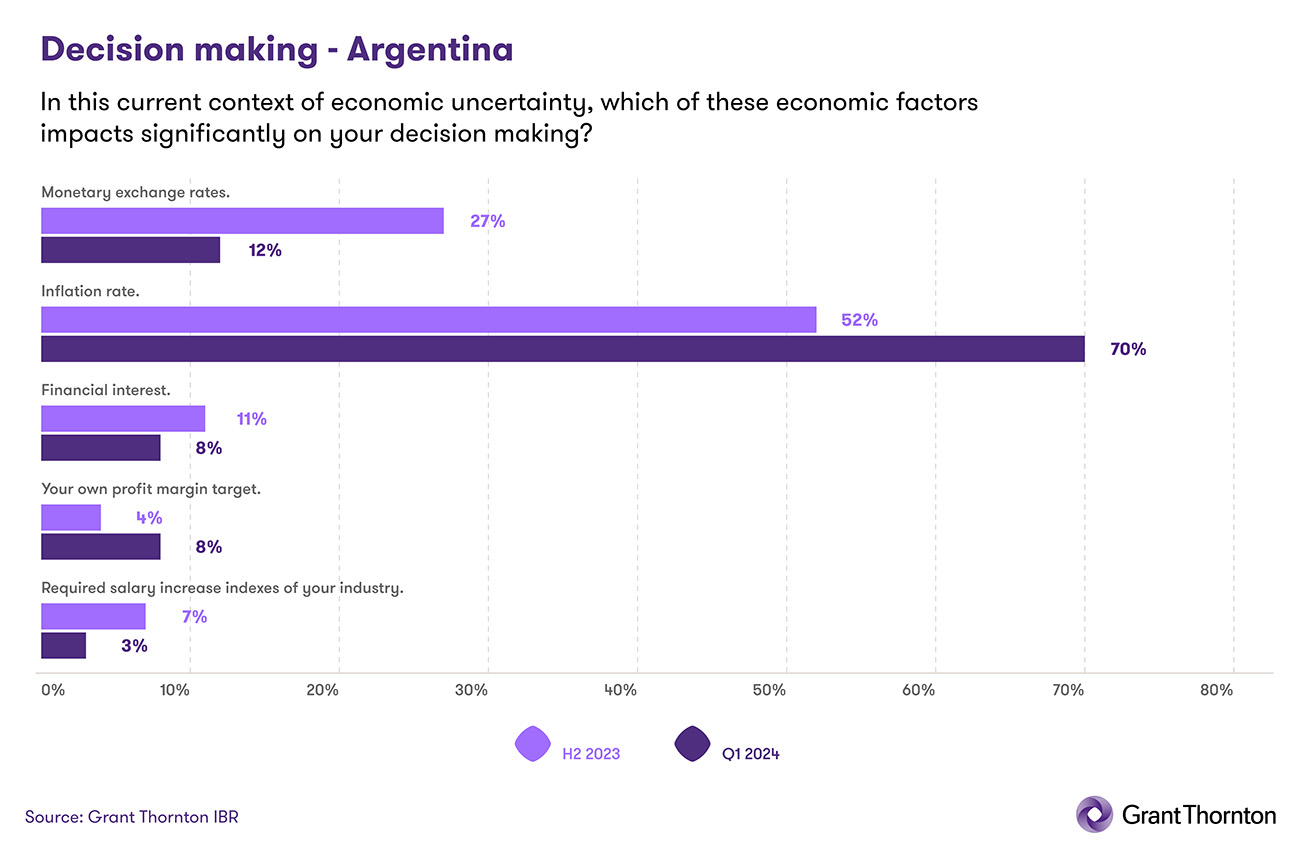

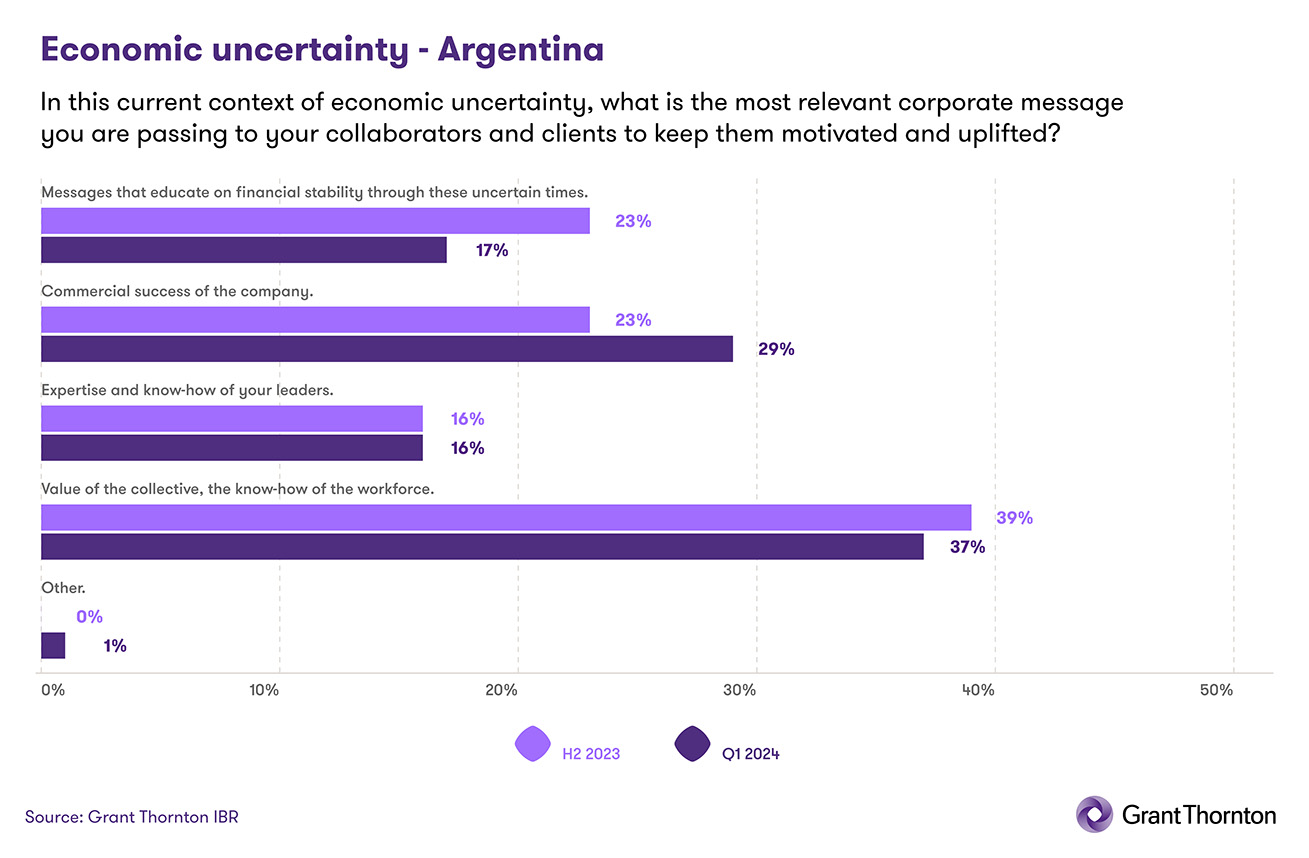

Since the second half of 2023, in addition to the questions asked of all respondents in more than 150 economies, the International Business Report includes three questions asked only to the 76 executives consulted in Argentina.

These questions refer to issues specific to our context. The first of them asks which factors are most relevant when making executive decisions; the second aims to investigate the main strategies of companies to attract and retain their collaborators; and the third question is related to the communication that companies reinforce in their teams in contexts of uncertainty.

Below are the variations in the answers to these questions from December 2023 to March 2024:

------

i. 2024 is a record year for #elections – here’s what you need to know. (2024, 2 enero). World Economic Forum. Recuperado de https://www.weforum.org/

ii. Govindarajan, V. (2024, 5 febrero). Why Are Companies Sitting on Cash Right Now? Harvard Business Review. Recuperado de https://hbr.org/